Adam Craggs

Partner and Head of Tax, Investigations and Financial Crime

London

If your organisation is unexpectedly the subject of a dawn raid, a regulatory investigation or is dealing with a workplace accident, you need a reliable crisis response team in your corner to navigate crisis incidents and avoid the pitfalls.

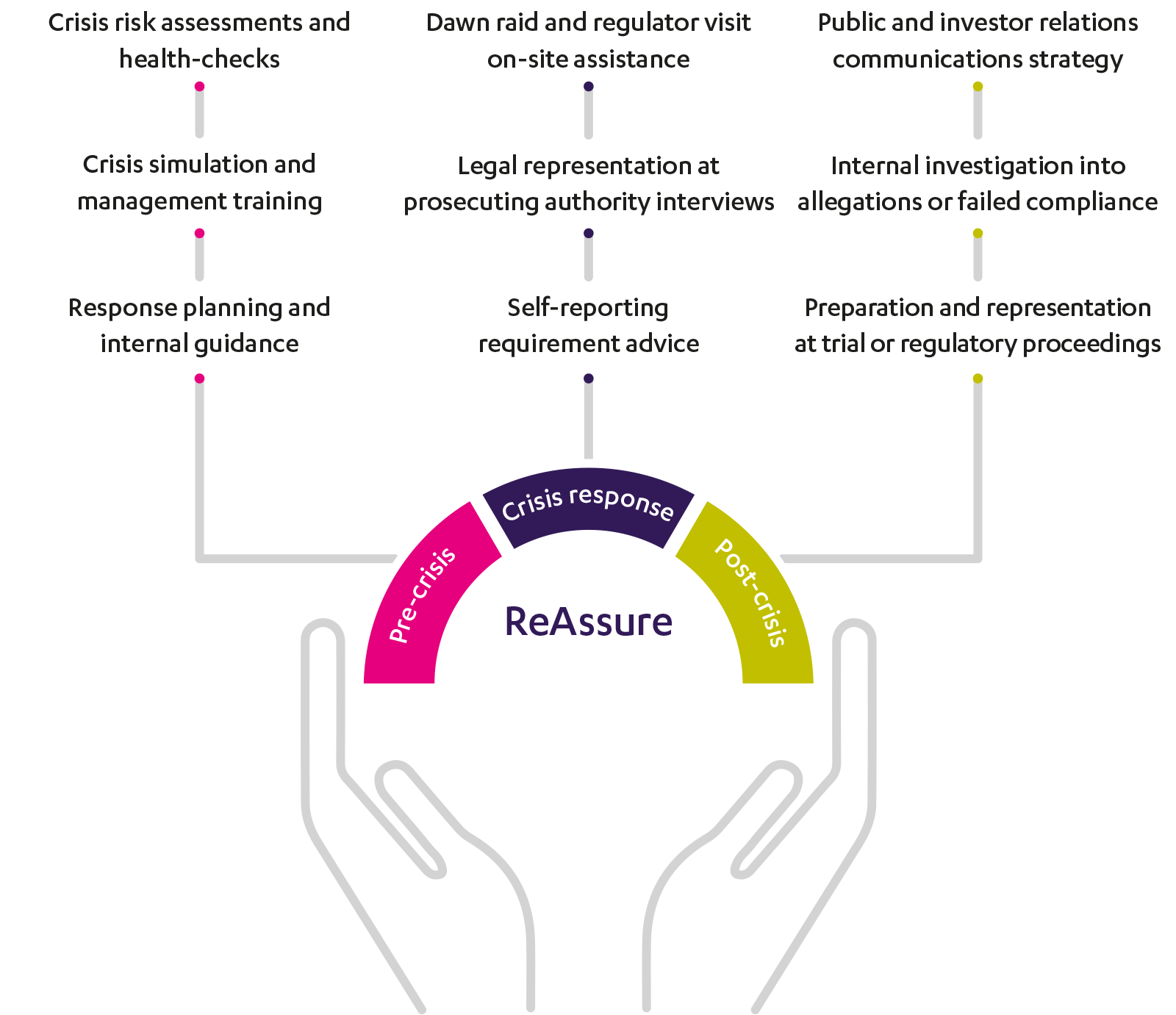

That’s where our ReAssure product comes in. All it takes is one call to bring together experts from across RPC, giving you access to clear legal and regulatory advice, as well as the best communications and public relations expertise.

ReAssure provides the support you need throughout a crisis situation, helping you manage, investigate, resolve, and recover.

Today’s focus on transparency demands a coordinated approach to any crisis. We understand the stress you’re under and the potential damage a crisis could do - we’re here to help you minimise reputational risks with a swift and effective response.

Our crisis management lawyers have proven track record in managing legal and PR challenges, combined with our deep regulatory expertise, means we can help you confidently navigate crises like dawn raids, workplace accidents, regulatory or criminal investigations, and product recalls. Know that our number one priority is to protect you and your interests.

Don't face a crisis alone. Partner with a crisis management firm that knows how to protect your interests and guide you through to resolution.

Thinking - Publication

Lawyers Covered - February 2026

Topic: Professional and Financial Risks

26.02.2026

Thinking - Blog

Purchase of an apartment and storage unit was a mixed-use acquisition for SDLT purposes

Topic: Tax Take

26.02.2026

This team are regularly instructed by top-end corporates to advise on regulatory investigations and corporate crime and to represent in criminal proceedings. RPC provides exceptional legal advice across the board. The team are incredibly bright and highly effective at winning cases, applying a no-nonsense, determined approach.

One of the market leaders in reputation management for defendants. A very good firm indeed.

The firm is simply the best defendant defamation team on the market."

Stay connected and subscribe to our latest insights and views

Subscribe Here